1.04 - Positioning & The 4 C's of Marketing

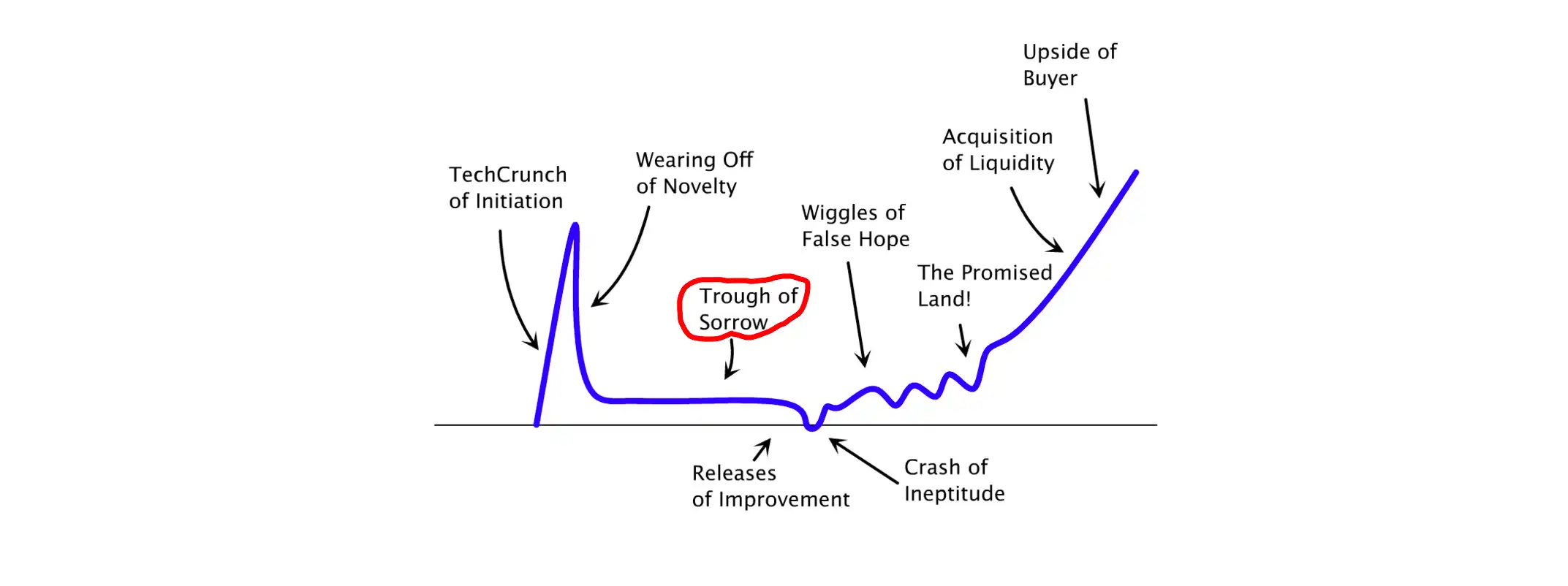

How To Escape The Startup Trough Of Sorrow

In this article we’ll explore how to escape the startup trough of sorrow by leveraging positioning and the 4 C’s - the most central ideas of marketing.

Johan Friedner // 2023-09-05

The trough of sorrow can show up in many stages of a company’s lifecycle. It can manifest after demo day with decreasing interest from customers. It can follow a launch of a new product where the excitement wears off. It can show up 5 or 10 years after the company started, when you're transforming into an enterprise but your competitors start to catch up.

The trough of sorrow is often defined as the period of hardship a company faces after a setback and can be very difficult for founders to deal with - regardless how experienced they are.

A 5 year old startup I consulted had product market fit (PMF) in a segment which was too small to generate substantial growth. While going after a more lucrative segment, competitors started to close in - diminishing profit from the original segment. How did we turn it around?

Positioning - this startup actually had PMF in both segments. The issue was their inability to communicate what they offered properly, leading to prospects choosing competitors instead. Changing their positioning and communication put this startup back on track.

What is brand positioning?

Positioning your brand/product in the market - in simple terms - is giving a clear articulation of what gives your brand an edge over competitors. It’s the communication around how you solve a customer's problem better than anyone else.

Agency folks sometimes express a piece of positioning work as “the big brand idea” which usually comes with a few supporting documents such as a brand manifesto, tone-of-voice and style guidelines. Strategists, designers and copywriters then build on these documents to develop assets like a brand book and ad campaigns.

The sandbox positioning document we will work to produce in this series can also be thought of as a “broad creative territory” that the company can play in over the next few years - informing your creative assets like design and copywriting. With new competitors constantly popping up and an ever changing market, positioning work is usually not meant to be permanent. Evolving trends often force brands to tweak their positioning or sometimes change it entirely.

This is especially true for startups - I’ve seen many strike a gold vein early with a huge growth curve in the first 3 years of existence. They then hit a trough of sorrow with a growth stall. This can be a sign that it’s time to revisit your positioning and adjust to the current needs of the market and make sure you’re still providing unique value that the new players on the block don't offer. Especially if you’re trying to go after a new or additional audience segment.

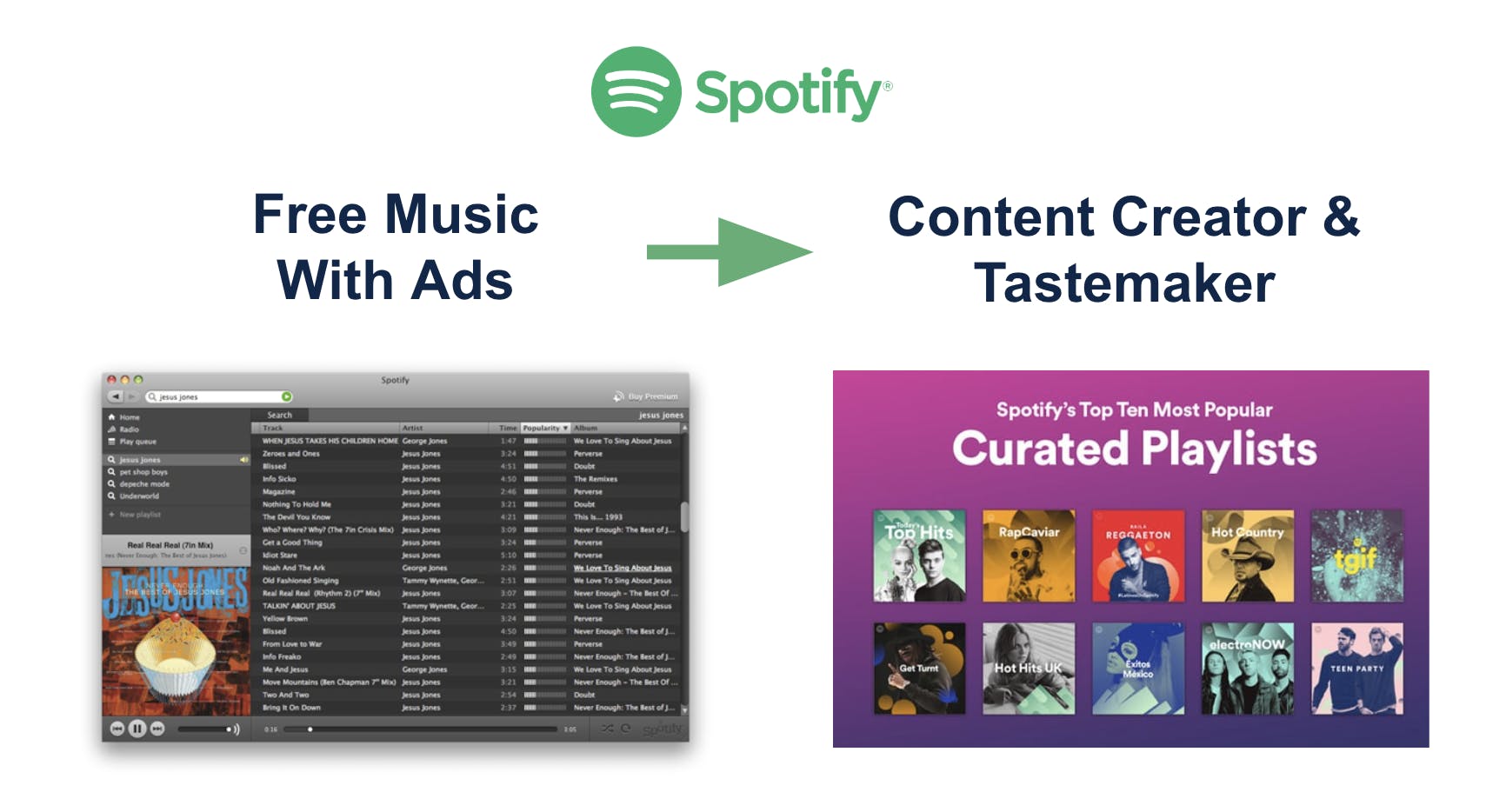

An example: Spotify might have seemed to be perfectly positioned for a long time as “free music with ads”. However, during recessions and pandemics many advertisers cut their budgets which hurts this type of business model. Spotify managed to reposition to a more successful model by starting to focus on their original content (like Netflix) and curated playlists. They became a tastemaker which skyrocketed their paid subscriptions.

Many brands I worked with only kept their positioning for 2-5 years at a time, then renewed it using extensive research to understand what aspects of the positioning to keep, tweak or cut - such as features, proof points and values to promote or de-emphasize. This is the type of research we will get into in this article.

How to develop a brand positioning strategy?

There are plenty of methodologies you can use to position your brand but all of them involve research. This is a core part of why marketing agencies get paid a lot of money and junior strategists (who do all the work) never get enough credit for. The research is often quite pseudoscientific but this doesn’t really matter - research doesn't have to be perfect to build a good narrative and create a strong brand.

In a nutshell, this research is about investigating different broad categories such as current trends, culture or consumer behaviour to find “insights” used to build your big brand idea. There are a million different frameworks that agencies use to structure their research (which all are sold and branded as their own proprietary methodology) but they all boil down to the same output.

I prefer the “4 C’s of marketing” framework which gives you a nice mix of insights relevant to the times, your target audience and the history and essence of your company and its founders.

The 4 C’s of marketing

Every agency and their mother have their own definition of the 4 C’s, what they stand for and when to use them - hence, they come with a bit of controversy in the marketing community. The most traditional definition is “Consumer, Cost, Convenience, Communications” (or the 4 P’s which are “Product, Price, Place, Promotion”).

The original 4 C’s, proposed by Robert Lauterborn in 1990 as a more consumer focused version of the 4 P’s are used as tools to pursue a company’s marketing objectives. We’re going to use a slightly different 4C framework for our research that in my experience have proven to be more effective in the early process of positioning:

- Consumer - Flesh out the segmentation research we just completed to find key “insights” about the behaviour and needs of our consumer.

- Competitors - An audit of our competitors strategic messaging and creative work to understand where the white space in our market lies.

- Culture - What cultural changes and trends are happening in society that our brand can join, take a position against or capitalise on in some way, shape or form.

- Company - Looking through the history and DNA of your (or your client’s) company, founding values and ideas that would be able to support our new positioning.

This methodology is not set in stone, so feel free to add any dimensions you want. I’ve seen strategists add geographics, human experiences, packaging and more but I found that most can usually be subcategories of my setup. The ones above are usually enough to get to a few good positioning territories to choose from.

The output of the 4C’s research can take many shapes - I’ve seen presentations as short as one slide per “C”, deriving one insight for each which comes together to inform a simple positioning statement that designers and copywriters can work off. Here is a made up example for a company selling bicycles:

Consumer - We ride to escape. To escape from our own thoughts. To find that state of flow. A sense of solitude, a form of meditation when your mind is completely free. It’s just you and your bike in the moment.

Competitors - A cluttered category filled with unnecessary gear - loud, colourful and ostentatious.

Culture - In an attempt to combat our busy, hectic lifestyles, people are decluttering. They’re seeking simplicity, buying less stuff and looking for ways to detach from this fast moving world.

Company - Cyckl makes high performance gear with purpose. Nothing is superfluous or unnecessary. It’s simple and understated. Beautifully clean.

Here the jump off point for creating a positioning statement could be something in the lines of “Enjoy the silence” - but I’m getting ahead of myself.

The above would be fine for a startup or positioning for an individual product as long as you can back up your narrative. However, this would not fly in most agencies with Fortune 500 enterprise clients demanding a larger body of research - otherwise, why would they pay those $400,000?

The common output I produced for clients involved presentations that told a full story, spanning 100s of slides. That might sound like a lot, but when presenting a key theme from every slide in around 10-20 seconds you end up with a nice 30 min presentation. Here is an old example from 2019 looking at insights around the logistics industry:

I want to stress that these slides would obviously be prettified by a designer before being shown to a client… Side note: It is quite interesting to read through all of these predictions before COVID was a thing.

Before we derive a few positioning territories to choose from, let's see how we can build a presentation like the one above by starting with the first C and explore how to get good Consumer insights.

Next module: Consumer insights and where to find them ->

Subscribe at the top of the page to be notified when a new article comes out.

Share with a colleague:

Link copied to clipboard!